Recap for June 5

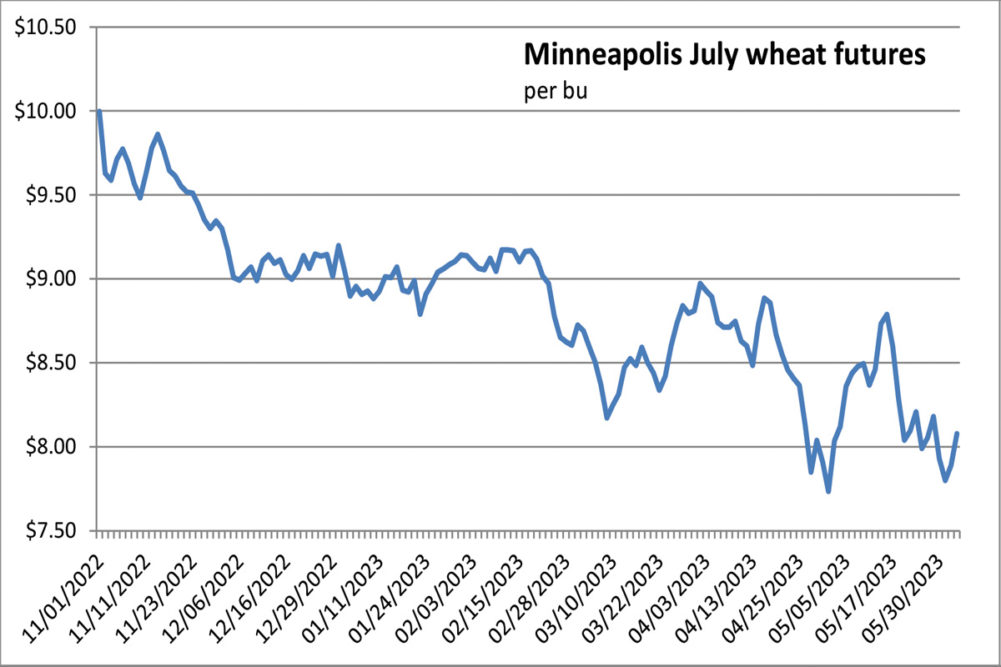

- Signals of further erosion of export demand for US supplies weakened sent corn and soybean futures lower Monday to open the trading week. Wheat futures, meanwhile, firmed with hard red winter and hard red spring contracts posting the widest gains as traders considered tight global stocks of high protein supplies and concerns that key growing areas of Europe and the Black Sea region could see harvests cut by dry soils. July corn futures were down 11½¢ to $5.97½ a bu. Chicago July wheat added 5¢ to close at $6.24 a bu. Kansas City July wheat jumped 10¢ to close at $8.22¼ a bu. Minneapolis July wheat advanced 12½¢ to close at $8.20¼ a bu. July soybeans dropped 2½¢ to close at $13.50 a bu. July soybean meal added $3.40 per ton to close at $401.20. July soybean oil retreated 0.24¢ to close at 49.26¢ a lb.

- US equity markets fell back Monday after the Institute for Supply Management said the services sector of the economy expanded more slowly in May than economists expected. Afterward, the two-year Treasury yield fell to 4.480% from 4.501% Friday, while the yield on the 10-year note closed at 3.691%, unchanged from Friday. The S&P 500 fell just short of a new bull market. The broad-based index had been in a bear market for 245 trading days, the longest stretch since 1948. The Dow Jones Industrial Average fell 199.90 points, or 0.59%, to close at 33,562.86. The Standard & Poor’s 500 fell 8.58 points, or 0.2%, to close at 4,273.79. The Nasdaq Composite dropped 11.34 points, or 0.09%, to close at 13,229.43.

- US crude oil futures were higher again Monday for a third consecutive session. The July West Texas Intermediate (WTI) light, sweet crude future advanced 41¢ to close at $72.15 per barrel. Support came after Saudi Arabia and the larger OPEC-plus group met over the weekend and agreed to more production cuts to compensate for weakening demand.

- The US dollar index posted a mixed close to open the trading week. The June dollar weakened but the September dollar strengthened slightly.

- US gold futures advanced, June gold adding $5.60 to close at $1,958.

Recap for June 2

- Wheat futures firmed on weather concerns in China after a key wheat-growing province received excessive and possibly crop damaging rains, plus lingering tensions over Ukraine supplies moving through the Black Sea corridor. Wheat also followed a firm trend established by corn and soybean futures lifted by bargain buying after some contracts struck multi-month lows in the week, dryness in the Midwest crop belt and spillover strength from equities and crude oil. July corn futures were up 16½¢ to close at $6.09 a bu. Chicago July wheat added 8¼¢ to close at $6.19 a bu. Kansas City July wheat added 9¾¢ to close at $8.12¼ a bu. Minneapolis July wheat jumped 18¾¢ to close at $8.07¾ a bu. July soybeans added 23¢ to close at $13.52½ a bu. July soybean meal dipped $3.60 per ton to close at $397.80; furthest deferred months were mixed. July soybean oil gained 1.64¢ to close at 49.50¢ a lb.

- US equity markets soared Friday after a Labor Department report indicated US employers added a seasonally adjusted 339,000 jobs in May and the prior two months’ payrolls were revised up by nearly 100,000. The Dow Jones Industrial Average added 701.19 points, or 2.12%, to close at 33,762.76. The Standard & Poor’s 500 advanced 61.35 points, or 1.45%, to close at 4,282.37. The Nasdaq Composite added 139.78 points, or 1.07%, to close at 13,240.77.

- US crude oil futures were higher again Friday. The July West Texas Intermediate (WTI) light, sweet crude future rose $1.64 to close at $71.74 per barrel. US crude still posted a weekly decline of 1.3%. Support came from the market cheering the Senate’s passage of a higher debt ceiling, essentially ending the uncertainty for market participants who feared a default would have deep macroeconomic consequences.

- The US dollar index flipped back to the strong side to close the week.

- US gold futures turned lower, the June gold futures shedding $25.60 to close at $1,952.40.

Recap for June 1

- A drying trend in the Midwest farm belt helped push soybean futures higher Thursday, as did a weakening US dollar and speculative buying at the dawn of June. Corn futures were higher, save the prompt month, the commodity’s inter-market spread widening on nearby demand woes and the same weather concerns supporting soybeans. Wheat futures were higher amid ultra-rainy forecasts for China’s top wheat-growing province of Henan where efforts to harvest grain already damaged by wet weather in late May could be set back. July corn futures were down 1½¢ to $5.92½ a bu, spreading from all deferred contracts, which were 5¾¢ to 8¾¢ higher. Chicago July wheat added 16½¢ to close at $6.10¾ a bu. Kansas City July wheat added 12¢ to close at $8.02½ a bu. Minneapolis July wheat jumped 9¢ to close at $7.89 a bu. July soybeans soared 29¾¢ to close at $13.29½ a bu. July soybean meal rose $8 per ton to close at $401.40. July soybean oil gained 1.66¢ to close at 47.86¢ a lb.

- US equity markets received a trading boost Thursday after a bill to avoid a default passed through the House of Representatives enroute to the Senate. The Dow Jones Industrial Average added 153.30 points, or 0.47%, to close at 33,061.57. The Standard & Poor’s 500 advanced 41.19 points, or 0.99%, to close at 4,221.02. The Nasdaq Composite jumped 165.70 points, or 1.28%, to close at 13,100.98.

- US crude oil futures were higher Thursday. The July West Texas Intermediate (WTI) light, sweet crude future rose $2.01 to close at $70.10 per barrel. It was the largest one-day gain since May 5 as investors veered toward ideas the OPEC-plus group will announce more production cuts this weekend, offsetting a buildup in US gas and crude inventories.

- The US dollar index weakened on Thursday.

- US gold futures continued higher. June gold added $14.10 to close at $1,978.

Recap for May 31

- Kansas City and Minneapolis wheat futures were mixed Wednesday, but Chicago soft winter wheat futures were higher on a bargain buying spree after the benchmark July contract hit its lowest level in almost 2½ years under pressure from macroeconomic concerns and strong export competition. Early declines in corn futures were erased by a weather-influenced round of short covering that brought the benchmark contract back to even on the day, though later contracts were under pressure and closed lower on contracting manufacturing activity in China and a stronger dollar. Soybeans were higher in the prompt contract on a short-covering bounce but later futures were lower on slowing commodity demand. July corn futures were steady at $5.94 a bu; the September contract and beyond were lower. Chicago July wheat added 3¼¢ to close at $5.94¼ a bu. Kansas City July wheat added 6¾¢ to close at $7.90½ a bu; the May 2024 future and beyond were lower. Minneapolis July wheat was down 13¢ to close at $7.80 a bu; the July 2024 future and beyond were higher. July soybeans added 3¼¢ to close at $12.99¾ a bu; though all later months were lower. July soybean meal edged up 80¢ per ton to close at $393.40. July soybean oil was steady at 46.20¢ a lb with most later contracts edging lower.

- Economic concerns and fears of another Fed interest rate hike pressured US equity markets Wednesday. Employer demand for workers remained strong as the economy gradually slowed, a Labor Department report indicated Wednesday. Employers reported a seasonally adjusted 10.1 million job openings in April, up from a revised 9.7 million in March. April’s increase reversed three months of declines. Layoffs fell to 1.6 million in April, from 1.8 million in March. The Dow Jones Industrial Average dropped 134.51 points, or 0.41%, to close at 32,908.27. The Standard & Poor’s 500 dropped 25.69 points, or 0.61%, to close at 4,179.83. The Nasdaq Composite fell 82.14 points, or 0.63%, to close at 12,935.29.

- US crude oil futures continued lower on Wednesday. The July West Texas Intermediate (WTI) light, sweet crude future fell $1.37 to close at $68.09 per barrel. Pressuring prices was an American Petroleum Institute report stating US commercial inventories of crude oil unexpectedly jumped by 5.2 million barrels last week, and that gasoline supplies climbed by 1.9 million barrels.

- The US dollar index reversed course and strengthened on Wednesday.

- US gold futures continued higher despite the dollar’s turnaround. June gold added $5.90 to close at $1,963.90.

Recap for May 30

- Strong global export competition and month-end selling weighed on wheat futures Tuesday, sending all contracts lower and some to nearly 2½-year lows. Soybean futures tumbled 3% on improving crop weather forecasts for June, month-end selling and debt ceiling pact concerns. Beneficial rain forecasts sent corn lower for the first time in six trading days. July corn futures fell 10¢ to close at $5.94 a bu. Chicago July wheat shed 25¢ to close at $5.91 a bu. Kansas City July wheat dropped 35½¢ to close at $7.83 a bu. Minneapolis July wheat was down 25¢ to close at $7.93 a bu. July soybeans dropped 40¾¢ to close at $12.96½ a bu. July soybean meal pulled back $9.60 per ton to close at $392.60. July soybean oil subtracted 2.62¢ to close at 46.20¢ a lb.

- Tech stocks led a rally Tuesday that sent the Nasdaq and S&P 500 indexes higher while the Dow industrial average declined. Artificial-intelligence firm Nvidia gained 3% after trading high enough at one point Tuesday to give the company a $1 trillion market capitalization, the first semiconductor company to achieve that level. The Dow Jones Industrial Average fell 50.56 points, or 0.15%, to close at 33,042.78. The Standard & Poor’s 500 edged up 0.07 point, to close at 4,205.45. The Nasdaq Composite added 41.74 points, or 0.32%, to close at 13,017.43.

- US crude oil futures retreated Tuesday. The July West Texas Intermediate (WTI) light, sweet crude future shed $3.21 to close at $69.46 per barrel. It was the largest one-day decline since May 3 and the lowest closing price since May 4. Pressure was derived from debt ceiling deal concerns, a possible rate hike at the Fed’s June meeting, and ideas that more Russian oil could soon hit the market.

- The US dollar index continued lower for a second session Tuesday after notching a three-day rally last week.

- US gold futures continued higher as the dollar descended. June gold added $13.70 to close at $1,958.